Is your invoice template contributing to late payment?

20/10/2020

We recently discovered a fundamental invoicing issue whilst conducting a credit management review for a client – an issue that was contributing to their customers taking longer to pay their invoices.

As is routine when we’re asked to help a business to improve their credit control, we review their processes, people, policies and systems to identify areas for improvement.

Our findings typically range from inefficiencies in the order-to-collections process to issues with the deliverability of invoices. But on this occasion, the business’s invoices were lacking a crucial piece of information: the payment terms.

Without it, customers had no firm timescale as to when the invoice needed to be settled. They were left to calculate themselves when the invoice would be due, based on the invoice date and the agreement that was in place with the supplier. As is to be expected, this meant that customers were not paying to terms.

How big an issue is this?

A crucial part of credit control – and invoicing – is to make it as easy as possible for your customers to pay you.

Whether it’s sending invoices to the people responsible for paying them, offering multiple payment methods or ensuring the description of the goods or services provided is clear, there are lots of ways to achieve this.

But by failing to specify the credit terms or the invoice due date (including both are preferable), there is an increased risk that there will be delay in the invoice being paid on time. Not only this, but it could also void any cover provided by credit insurance providers if terms are not clearly stated.

What should my invoice include?

It’s amazing how often we see invoices lacking the most important information – information that has such a bearing on the likelihood of invoices being paid on time.

When did you last review your invoice design? Are you confident it includes everything it should? And have you tried tweaking it to see what impact it has on customer payment times?

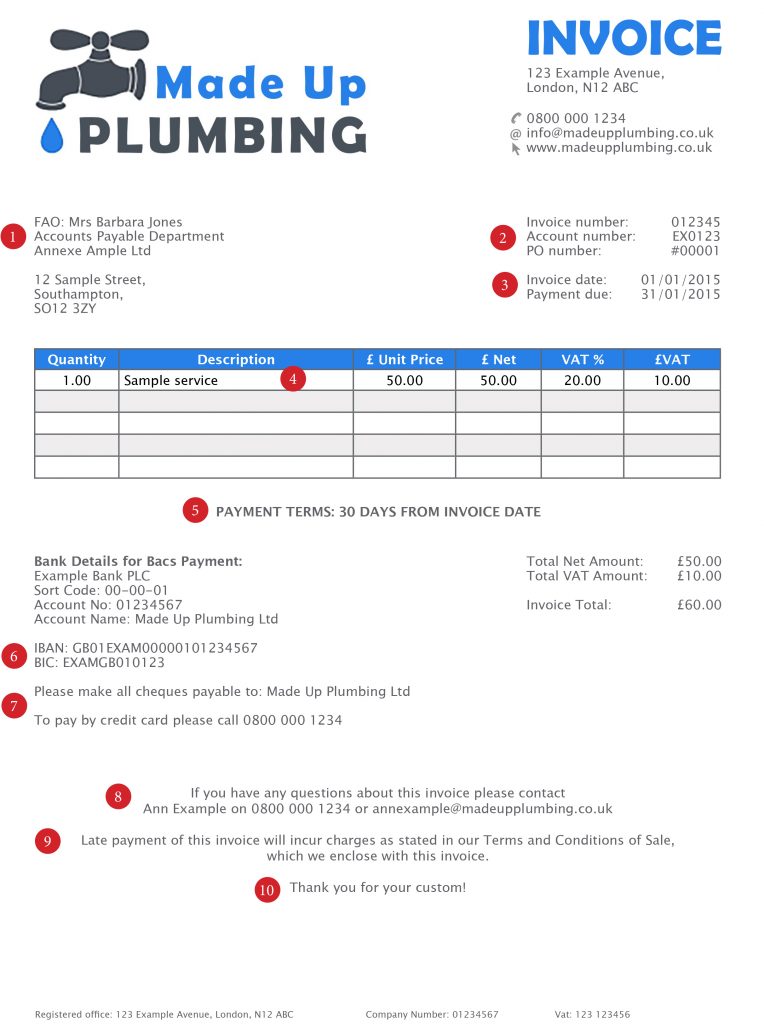

Using our two decades’ experience as a debt collection agency, we’ve come up with what we believe to be a flawless invoice template to compare yours with – highlighting the 10 characteristics we think are most important (scroll down for more about each one).

How does yours compare? We hope you find it useful.

1. Address the invoice to the most relevant person

Always make sure that you have addressed the invoice to the most relevant person at the company. This is particularly important when dealing with large businesses, as the person you are corresponding with will not necessarily be the person in charge of paying you. If you’re not sure who the correct contact is, ask. You can do this when placing the order or via account opening forms at the beginning of the sales process.

2. Quote reference numbers

All three of these reference numbers can be useful for your and your customer’s records when processing the invoice. These reference numbers should also be quoted on any following correspondence which relates to payment of this specific invoice.

3. Provide a specific payment date

Just like the business we recently visited, many fail to specify the exact date that payment must be received by. This will reduce the chances of your customer missing the deadline date as it is made very clear from the outset.

4. Provide a description of the product or service provided

An invoice should always include a detailed description of the goods or services supplied, to make clear to the customer what they are being billed for. It may be a good idea to include who purchased the products or services here. Also, never add on undiscussed fees as this could anger your customer, lead to disputes and cause them to refuse to pay the outstanding balance. If the price is higher than what’s been quoted, explain this to your customer before sending the invoice.

5. Clearly state payment terms

As we’ve already mentioned, always include your credit terms in a prominent position that your customer can clearly see. This is one of the most important pieces of information on the invoice and should not be hidden away. If your credit terms are not visible your customer may put it to the bottom of their payment pile as it may not appear to be as urgent as their other invoices.

6. Provide IBAN number

When invoicing a client outside the UK you need to give them your IBAN and BIC code so that they can make a payment to you from abroad without delay. It’s a good idea to include these details as part of your standard invoice template so that it is never accidentally missed off.

7. Give details of all acceptable payment methods

Make it easy for your customer to pay you by clearly detailing all acceptable payment methods on your invoice. It’s always good to give customers a choice, so where possible try to offer a range of payment methods. But make it clear how they should pay and remember to include any details they might need, whether they’re based here in the UK or overseas.

8. Provide contact details

It’s important to clearly provide your accounts team’s contact details. In event of a dispute, this helps your customer to raise the dispute sooner, enabling you to get to work resolving it. This can avoid lengthy delays associated with disputes.

9. Make reference to your late payment procedure

A good tactic is to include your business’s credit control procedure in the event of late payment. This could be charging interest, taking legal action or referring the debt to a collections agency after a certain delay. While you may not want to go into detail on the invoice, you can point the customer towards your Terms and Conditions, which should give all the relevant information. By demonstrating from the outset that you take a strong stance against late payment you significantly reduce the chances of being paid late.

10. Say thank you

It’s always nice to say thank you. Not only is it polite, it also shows you’re grateful for their custom, improves customer relations and can lead to subsequent sales.

Other essential invoicing tips

Remember, this is just a guide and your business may need to include other details which we have not provided above.

You can also get creative. A handwritten post-it note saying ‘thank you’ could be a great way to convey warmth, build brand loyalty and reduce the chances of your customer delaying payment.

And, don’t forget, creating the perfect invoice doesn’t stop once you have developed a professional and effective design. You also need to ensure that, for every invoice, you:

- Proofread for grammar, spelling and mathematical mistakes

- Send it promptly to avoid delays

- Save a copy for your records

- Check it has been received with a quick courtesy call

- Chase it up immediately in the event the invoice exceeds terms

And in the event you’re using factoring as a means to improve cash flow, by accessing up to 90% of an invoice’s value within 24 hours, ensure your invoice contains a notice of assignment. Read more about the benefits of factoring and how it works here.

Can we help?

If late payment is affecting your cash flow, you’re spending too much time chasing late paying customers or you lack the in-house resource, our award-winning team here at Hilton-Baird Collection Services can help. To discuss your options, request a call back at a convenient time or get an instant debt collection quote.

Comments